The sale of auction lots is subject to differential taxation. The acquisition price forms the basis for calculating the premium to be paid by the buyer. A fee of €3 is charged per auction lot. No VAT is indicated for goods that are subject to differential taxation.

For buyers in European Union ...更多

For buyers in European Union countries: Consumers pay a standard premium of 26,2% plus lot fee, postage and insurance.

For Traders (as defined in the German VAT Act – UStG) pay a premium of 26,2% on goods that are subject to differential taxation (this premium includes 19% VAT) plus lot fee, postage and insurance. In the case of goods that are subject to regular taxation, a premium of 22% is charged, plus 19% VAT charged on the total sum of acquisition

price, premium, lot fee and postage/insurance. The movement of goods within the EU can be exempted from VAT in accordance with statutory provisions.

For buyers resident in third-party countries (outside the EU): Buyers pay a 22% premium plus lot fee, postage and insurance. If Auktionshaus Ulrich Felzmann GmbH & Co. KG exports the goods to third-party countries itself, the invoice will not contain VAT. If the goods are exported by the buyer him/herself or via a third party, VAT will be charged and reimbursed on presentation of the necessary proof of export.In all cases, the buyer him/herself will assume any import taxes or customs duties.

A premium of 22% will be charged for gold coins that are exempt from VAT.

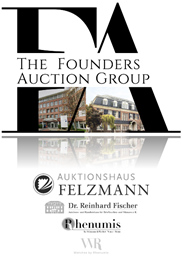

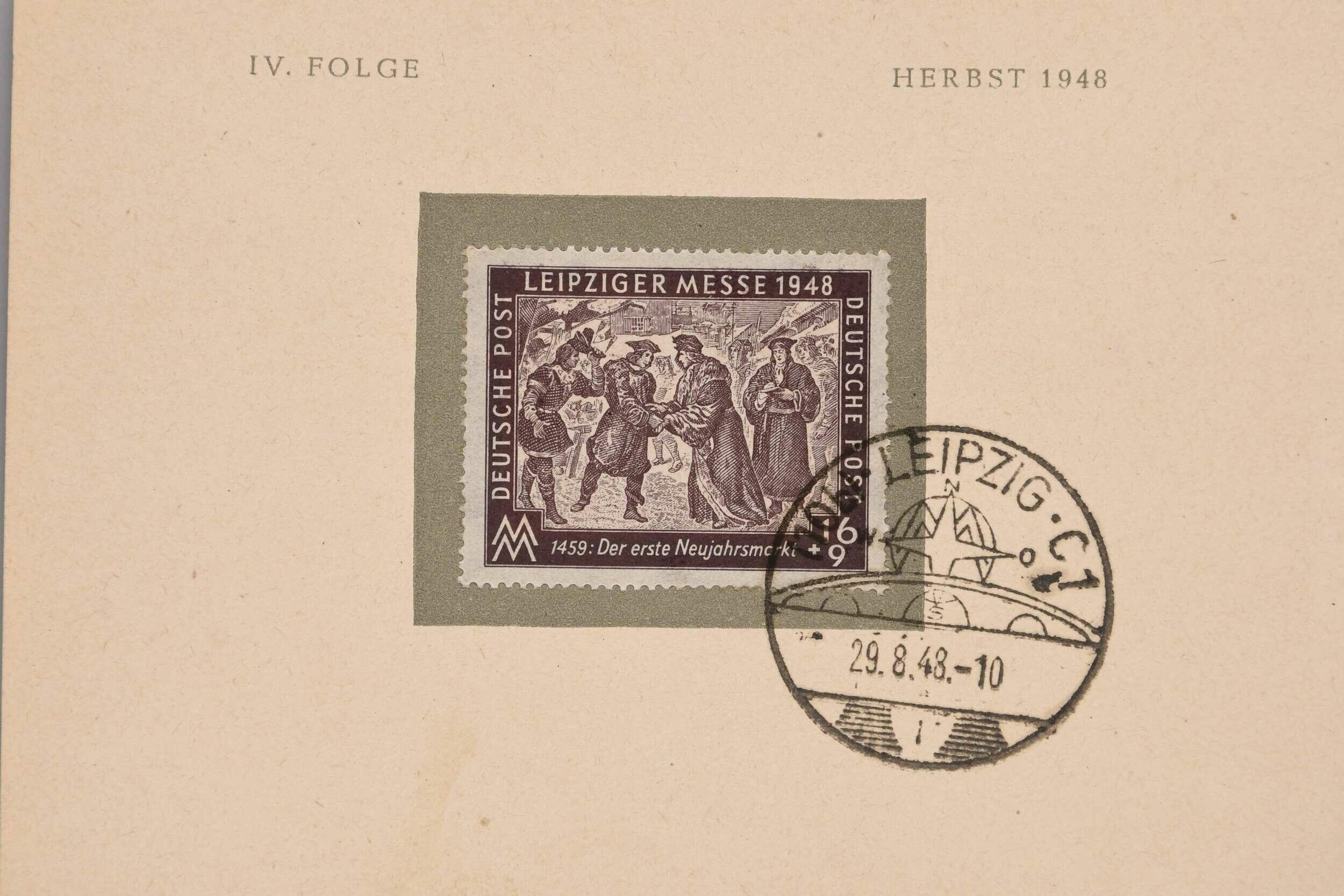

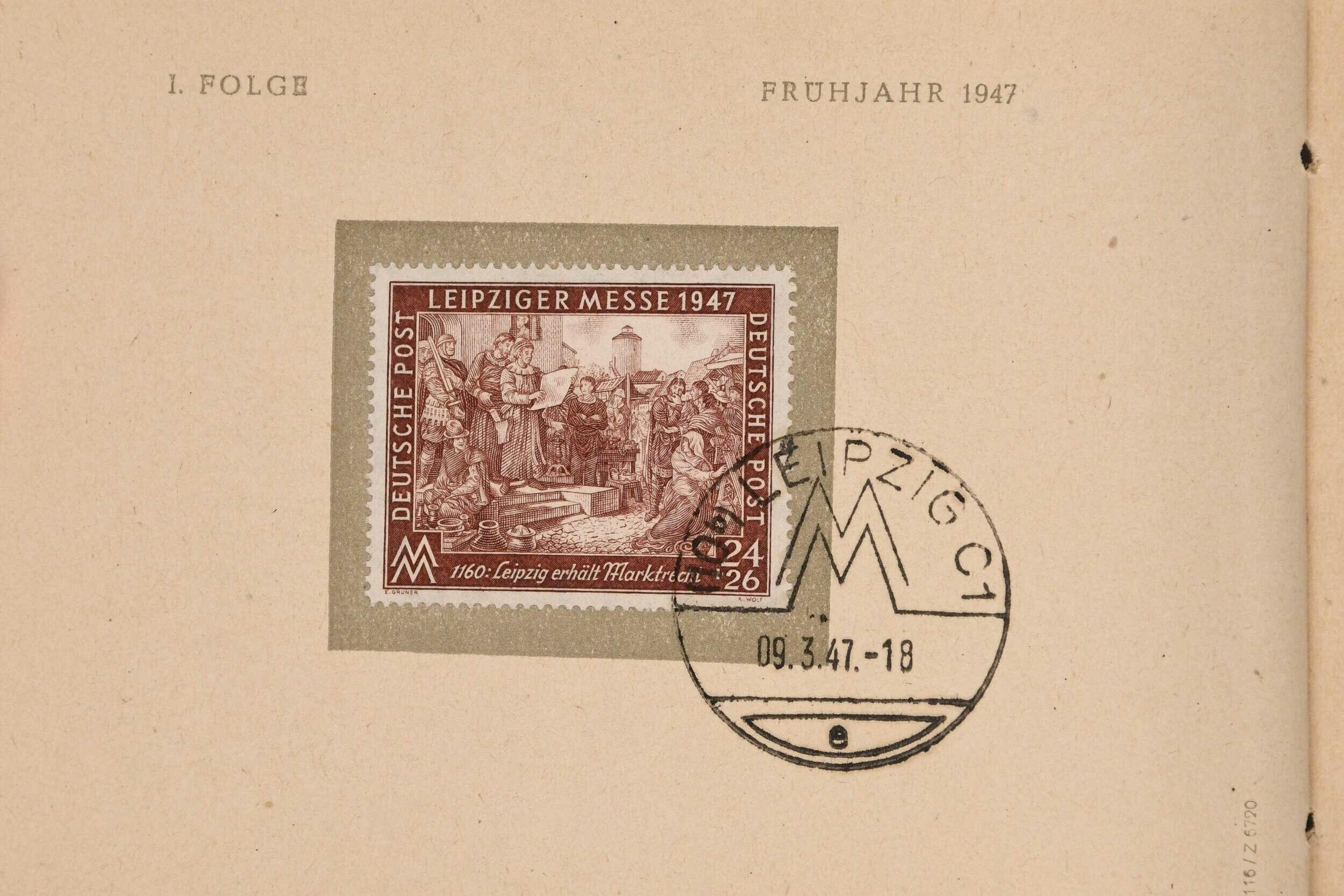

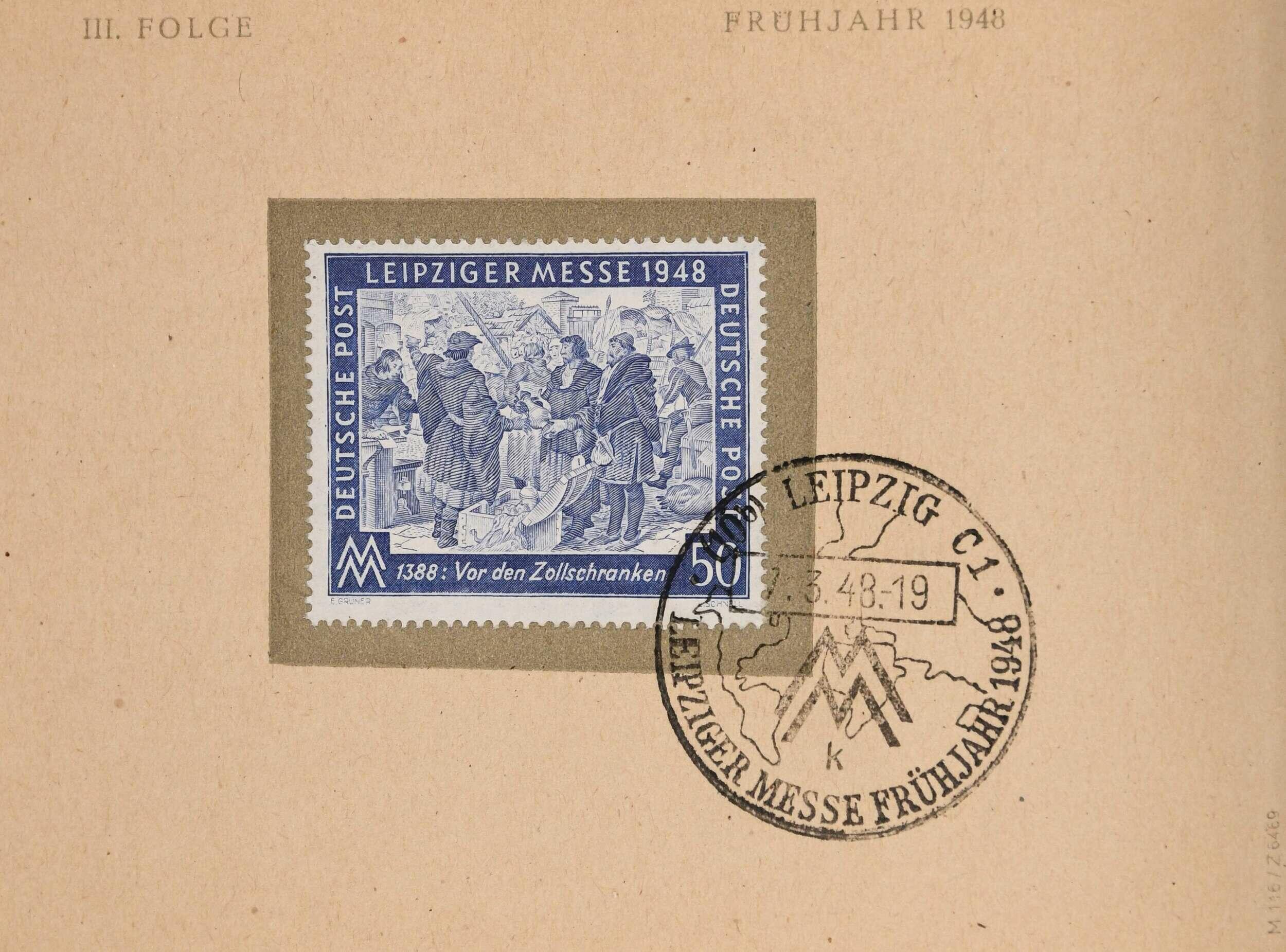

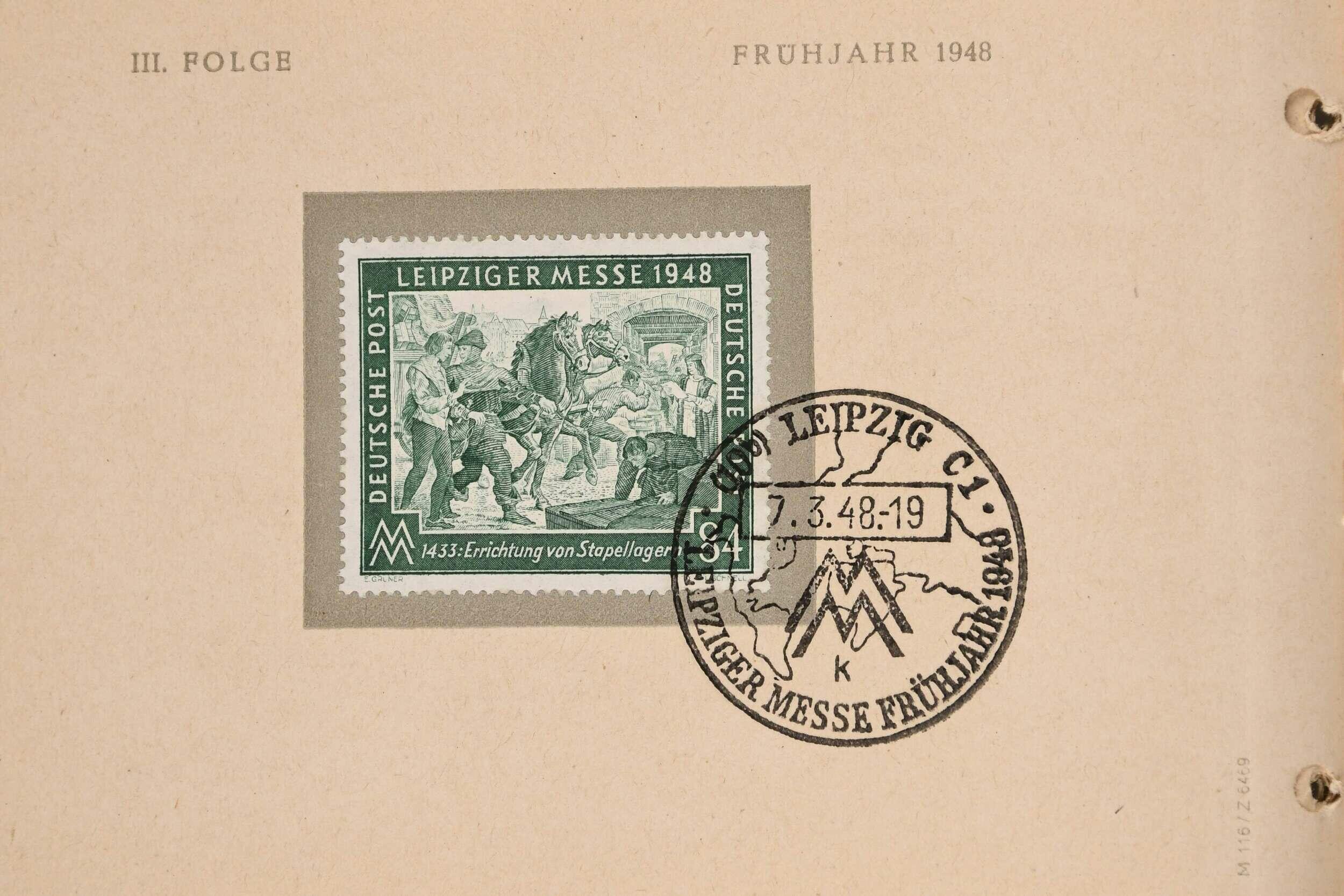

拍項 5121 二次大戰後德國蘇聯佔領區

5 Messe-Büchlein des Leipziger Messeamtes mit farbigen

Reproduktionen der Messemarken Kontrollrat und SBZ, dazu einige

Ergänzungen

Automatically generated translation:

5 fair booklet of the Leipzig fair office with coloured reproduction the fair stamps Control Council and Soviet Zone, in addition to it a few additions