Münz Zentrum Rheinland

The knock-down price is the basis for the calculation of the buyer`s surcharge. For buyers from EEC countries the following applies: for consumers there is a standard surcharge of 23 % (relevant VAT already included). For traders according to the Value Added Tax Act the surcharge is 23 % (relevant ...mehr

goods delivered by standard taxation the surcharge is 20 % plus the relevant VAT on the entire amount of hammer price and surcharge.

Purchasers from abroad will be charged a surcharge of 20 % net on the knock-down price, provided the export of the coins ist undertaken by the auctioneer. Buyers in European Community (EEC) countries (other than Germany) will be charged Value Added Tax at the rates prevailing in Germany.

Dealers from EEC countries (other than Germany) will receive goods free of tax upon presentation of their VAT I.D. number, and upon ful fillment of the other conditions set forth in Paragraph 4, Nr. 1 b, and Paragraph 6 a of the German Turnover Tax Law, they will be charged a surcharge of 17 %. For gold coins, which are not subject to the legal VAT , the surcharge is 15 % of the hammer price.

Special Regulation: Lower Premium for Gold Coins

Gold coins from 1800 onwards, provided they are at least 900g finely alloyed and, including the premium, do not exceed 250% of the current annual gold price (2025) of €80,555 per kg, are exempt from VAT. If they fall below the alloy value or exceed 250% of the gold price, they are subject to standard VAT (differential tax). Gold coins and other gold objects (e.g., medals) are subject to fluctuating prices. Auction regulations prohibit gold and silver from being sold below their current market price. The minimum bid price is therefore adjusted to the current market price. The estimated prices were provisionally set early on during the auction compilation; the starting price is adjusted for the auction and announced at the auction. The premium is 10% for gold coins without VAT, and 15% for gold coins and medals with differential tax. The same applies to third-party countries and dealers.

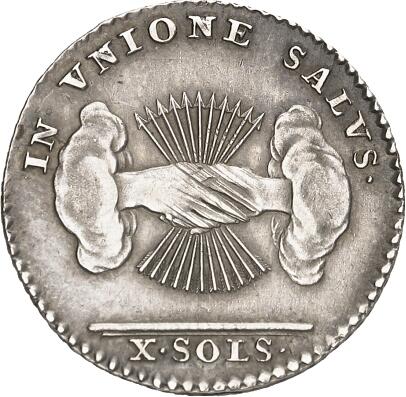

Lot 2463 Soulèvement belge Europe - Belgique - 1790-1792

Römisch Deutsches Reich.

Belgischer Aufstand 1789-1790. X Sols oder 1/2 Florin 1790

Brüssel mit IN VNIONE SALVS, n. r. steigender Löwe / Verschlungene

Hände mit Pfeilbündel. J./J. 64, Her. 5. .

Erhaltung: ss

Schätzpreis: 100

Automatically generated translation:

Roman German Reich. Belgian uprising 1789-1790. X Sols or 1/2 florin 1790 Brussels with IN VNIONE SALVS, to the right increasing lion / entwined hands with sheaf of arrows. J. / J. 64, here. 5. Condition: very fine estimated-price: 100