Teutoburger Münzauktion GmbH

ロット4629

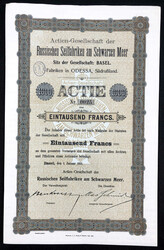

Aktie über 1000 Francs, Basel 1. Januar 1910. もっと見る

Aktie über 1000 Francs, Basel 1. Januar 1910. Actien-Gesellschaft

der Russischen Seilfabriken am Schwarzen Meer in Odessa,

Südrußland. Nr. 0025. III, selten

Automatically generated translation:

Share over 1000 Franc, Basle 1. January 1910. Actien society of the Russian sailing factories at the black ocean in odessa, South Russia. No. 0025. III, rare

Automatically generated translation:

Share over 1000 Franc, Basle 1. January 1910. Actien society of the Russian sailing factories at the black ocean in odessa, South Russia. No. 0025. III, rare

Eppli

ロット34

+1枚

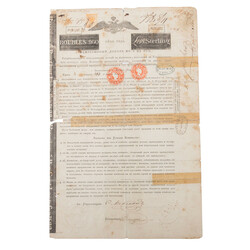

Russische Staatsanleihe von 1822, unterzeichnet von Nathan Mayer もっと見る

Russische Staatsanleihe von 1822, unterzeichnet von Nathan Mayer Rothschild (1777-1836), im Nennwert von 960 Rubel (148 Pfund Sterling), versehen mit einem Zinssatz von 5 % pro Jahr. Talon auf der Rückseite erhalten. Beidseitig teilweise gedruckt, dreisprachig. Masse (HxB): ca. 36,5 x 23,8 cm. Am oberen rechten Rand in Tinte von Rothschild signiert. Alters- und Gebrauchsspuren, leichte Verfärbungen, minimal stockfleckig, Papierverluste und Risse in den sich kreuzenden Falten, Klebespuren. PROVENIENZ: Adam Historical Shares, Berlin 1989. ANMERKUNG: Nathan Mayer Rothschild (1777-1836) war eine Schlüsselfigur der europäischen Finanzwelt und begründete die einflussreiche Bankiersdynastie der Familie Rothschild. Besondere Bekanntheit erlangte er durch seine Beteiligung an der Finanzierung der alliierten Mächte während der Napoleonischen Kriege. Nach den Kriegen spielte Rothschild eine entscheidende Rolle bei der internationalen Finanzierung europäischer Staaten. Ein Beispiel dafür ist die vorliegende Russische Staatsanleihe von 1822. Das zaristische Russland nahm damals eine Anleihe in Höhe von 3.500.000 Pfund Sterling auf, um seine Staatsausgaben zu finanzieren. Diese Anleihe war besonders, weil sie in Pfund Sterling notiert war und die Zinszahlungen in London erfolgten. Diese Struktur stärkte nicht nur das Vertrauen internationaler Investoren, sondern festigte auch Londons Position als führender Finanzmarkt Europas. Die Anleihe war frei übertragbar und diente sowohl als Anlageobjekt als auch als Sicherheit für Kredite. Die jährlichen Zinszahlungen konnten in St. Petersburg oder London geltend gemacht werden, was die Internationalität und Bedeutung dieses Finanzinstruments unterstreicht. Somit ist sie ein faszinierendes Zeugnis der frühen internationalen Kapitalmärkte und der zentralen Rolle der Familie Rothschild bei der Finanzierung staatlicher Vorhaben

Automatically generated translation:

Russian government bond from 1822, signs from nathan Mayer Rothschild (1777-1836), in the nominal value from 960 Rouble (148 pound sterling), equipped with an interest rate from 5 % per year. Talon on the back condition. On both sides partial printed, trilingual. Bulk (Hx B) : approximate 36, 5 x 23, 8 cm. At the upper right margin in ink from Rothschild signed. Traces of age and usage, slight discolouration, minimal foxed, paper losses and tears in the be crossing fold, adhesive patches. Provenance: Adam Historical Shares, Berlin 1989. Annotation: nathan Mayer Rothschild (1777-1836) was a key figure the European financial world and founded the influential Bankiersdynastie the family Rothschild. Special awareness became he through his participation at the factoring the allied powers during the Napoleonic wares. To the to get pretended Rothschild a decisive roll by of the international factoring European states. An example for that is the existing Russian government bond from 1822. The czarist Russia took at that time a borrowing in the amount of 3.500.000 pound sterling on, about his government expenditure to to bankroll. These borrowing was especially, because they in pound sterling listed was and the interest payments in London resulted. These texture strengthened not alone the to confide international investors, but rather solidified also Londons position as leading capital market Europe. The borrowing was negotiable and served both as concern object as also as security for credits. The yearly interest payments could uncirculated Petersburg or London alleged become, what the internationality and meaning this Finanzinstruments punctuates. Therefore is they a fascinating certificate the early international capital markets and the central roll the family Rothschild at the factoring national intend

Automatically generated translation:

Russian government bond from 1822, signs from nathan Mayer Rothschild (1777-1836), in the nominal value from 960 Rouble (148 pound sterling), equipped with an interest rate from 5 % per year. Talon on the back condition. On both sides partial printed, trilingual. Bulk (Hx B) : approximate 36, 5 x 23, 8 cm. At the upper right margin in ink from Rothschild signed. Traces of age and usage, slight discolouration, minimal foxed, paper losses and tears in the be crossing fold, adhesive patches. Provenance: Adam Historical Shares, Berlin 1989. Annotation: nathan Mayer Rothschild (1777-1836) was a key figure the European financial world and founded the influential Bankiersdynastie the family Rothschild. Special awareness became he through his participation at the factoring the allied powers during the Napoleonic wares. To the to get pretended Rothschild a decisive roll by of the international factoring European states. An example for that is the existing Russian government bond from 1822. The czarist Russia took at that time a borrowing in the amount of 3.500.000 pound sterling on, about his government expenditure to to bankroll. These borrowing was especially, because they in pound sterling listed was and the interest payments in London resulted. These texture strengthened not alone the to confide international investors, but rather solidified also Londons position as leading capital market Europe. The borrowing was negotiable and served both as concern object as also as security for credits. The yearly interest payments could uncirculated Petersburg or London alleged become, what the internationality and meaning this Finanzinstruments punctuates. Therefore is they a fascinating certificate the early international capital markets and the central roll the family Rothschild at the factoring national intend

Y年m月d日@H:i